College is becoming more expensive each year. For parents and loved ones, it’s more urgent than ever to start saving for it early.

Fortunately, there are various ways to save for college.

A 529 plan is one popular method utilized by parents. 529s are state-sponsored plans that offer tax benefits if funds are used for qualifying educational expenses. While 529s are limited as to what funds can be used for, the tax benefits are attractive — making the 529 plan an attractive option for parents who are confident that their children will go to college.

But what are these benefits, exactly? Are 529 contributions tax-deductible? And what is the 529 tax deduction 2022? This article will offer some answers to these questions.

{{cta-1}}

What Is the 529 Tax Deduction?

The 529 plan is a tax-advantaged account designed to help pay for college or other qualifying education expenses.

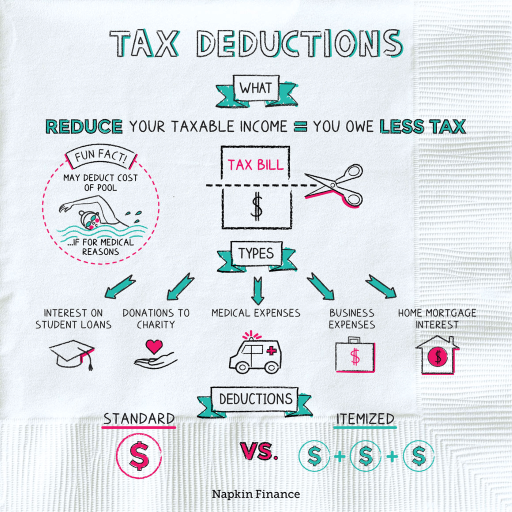

A tax deduction is a qualifying expense that allows you to reduce the amount of taxable income that you owe tax on. For example, if you earn $50,000 and qualify for a $4,000 deduction, you’ll only have to pay income tax on $46,000.

Unfortunately, 529 plans don’t offer this type of upfront deduction — at least, not on the federal level.

529 plans offer generous tax benefits, but they have no effect on current-year federal taxes.

The primary tax benefit of a 529 plan is tax-free growth. The plan’s beneficiary will be able to invest the funds and watch them grow tax-deferred. And when they eventually withdraw, the funds won’t be subject to income or capital gains taxes — as long as the money is used for qualifying education expenses.

In other words, when it comes to federal taxes, 529 college savings plans have no upfront benefit for the contributor. There are huge benefits for the beneficiary, however.

Many states offer a 529 tax deduction for state-level taxes. This can help you reduce your taxable income on your state return each year, thereby saving money.

Are 529 contributions tax-deductible?

At the federal level, 529 contributions are not tax-deductible.

On the state level, 529 contributions are tax-deductible in most states. The rules differ slightly by state. In most cases, the taxpayer must contribute to their home state’s sponsored 529 plan to qualify for a tax deduction.

Most states offer tax benefits from 529 contributions. The only states that do have state income tax but don’t offer a 529 deduction are California, Hawaii, and Kentucky.

So, there is no California 529 tax deduction, but there is an Illinois 529 tax deduction. Tax filers should check with their state taxation department for details.

State-level 529 tax benefits will be covered in more detail below.

State Tax Benefits of 529 Accounts

The majority of states offer 529 tax deductions in 2023 and beyond. This can be confusing, however, because the rules vary. For example, the Massachusetts 529 tax deduction is completely different from the New York 529 deduction.

Which states offer 529 tax deductions? The majority that have income taxes now offer some tax benefits for 529 contributions.

There are a few factors to be considered:

Maximum deductions: Most states have a maximum amount that you can deduct. If the max is $2,000 per year, you can only deduct $2,000 from your taxes — even if you contributed $5,000. There is usually a separate, doubled maximum for couples filing jointly.

Carry-forward: Some states allow you to carry forward excess contributions to future years. For example, Connecticut has a five-year carry-forward rule. You can deduct up to $5,000 per year. If you contribute $15,000 in a given year, you could deduct $5,000 that year and then carry forward the remaining $10,000 for future years.

States with a 529 tax deduction

For these states, taxpayers can deduct 529 contributions. You will also find details on the maximum amount that can be deducted per year.

- Alabama - Up to $5,000 per year for single filers/$10,000 joint

- Arizona - Up to $2,000 per year for single filers/$4,000 joint

- Arkansas - Up to $5,000 per year for single filers/$10,000 joint

- Colorado - Full amount of contribution

- Connecticut - Up to $5,000 per year for single filers/$10,000 joint (five-year carry-forward on excess contributions)

- Delaware - Up to $1,000 per year for single filers/$2,000 joint

- Georgia - Up to $4,000 per year for single filers/$8,000 joint

- Idaho - Up to $6,000 per year for single filers/$12,000 joint

- Illinois - Up to $10,000 per year for single filers/$20,000 joint

- Indiana - 20% tax credit on contributions up to $5,000 ($1,000 maximum credit)

- Iowa - Up to $3,785 per year beneficiary

- Kansas - Up to $3,000 per year for single filers/$6,000 joint

- Louisiana - Up to $2,400 per year for single filers/$4,800 joint (unlimited carry-forward on excess contributions)

- Maine - Up to $1,000 per year per beneficiary

- Maryland - Up to $2,500 per year for single filers/$10,000 joint (10-year carry-forward)

- Massachusetts - Up to $1,000 per year for single filers/$2,000 joint

- Michigan - Up to $5,000 per year for single filers/$10,000 joint

- Minnesota - Up to $1,500 per year for single filers/$3,000 joint

- Mississippi - Up to $10,000 per year for single filers/$20,000 joint

- Missouri - Up to $8,000 per year for single filers/$16,000 joint

- Montana - Up to $3,000 per year for single filers/$6,000 joint

- Nebraska - Up to $5,000 per year for single filers/$10,000 joint

- New Jersey - Up to $10,000 per year for single filers (new in 2022)

- New Mexico - Full amount of contribution

- New York - Up to $5,000 per year for single filers/$10,000 joint

- North Dakota - Up to $5,000 per year for single filers/$10,000 joint

- Ohio - Up to $4,000 per year for single filers (unlimited carry-forward on excess contributions)

- Oklahoma - Up to $10,000 per year for single filers/$20,000 joint (five-year carryforward of excess contributions)

- Oregon - Tax credit of up to $150 single/$300 joint. The tax credit replaced the old tax deduction for Oregon 529s.

- Pennsylvania - Up to $17,000 per year for single filers/$34,000 joint

- Rhode Island - Up to $500 per year for single filers/$1,000 joint (unlimited carry-forward of excess contributions)

- South Carolina - Full amount of contribution

- Utah - 4.85% tax credit on contributions of up to $2,040 single/$4,080 joint

- Vermont - 10% tax credit on up to $2,500 single/$5,000 joint

- Virginia - Up to $2,000 single/$2,000 joint beneficiary, or full contribution for taxpayers over 70

- Washington, DC - Up to $4,000 per year for single filers/$8,000 joint

- West Virginia - Full amount of contribution

- Wisconsin - Up to $3,860 per year for single filers or $1,930 per beneficiary for married filing separate

States with no 529 deduction

The following states have a state-level income tax, but 529 contributions are not tax-deductible:

Note that these states still have 529 plans available, and residents of these states can still take advantage of federal tax benefits.

States with no income tax

For the following states, a deduction is irrelevant because there is no state-level income tax:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming - WY is the only state to no longer offer a 529 plan

Note that these states still have 529 plans available (with the exception of Wyoming), and residents of these states can still take advantage of federal tax benefits.

How much is the 529 deduction worth?

The image above demonstrates the potential tax savings of a couple contributing $100 per month ($1,200 per year) to two children’s 529 accounts. These examples are based on a household income of $100,000.

Most states offer tax savings between $60 and $120. A few outliers offer substantially more, while a handful offer no benefit at all. Again, this is based on a contribution of $2,400 total ($1,200 for each child); the deduction amount will change depending on how much you contribute.

The specific amount you will save depends on several factors, including:

- What state you live in

- What the deduction rules are

- How much money you earn

- How much you contribute to a 529

The only way to accurately assess how much the state 529 tax deduction can save you is to calculate the numbers in your situation. You may wish to consult with a qualified tax advisor or CPA for help.

You can get a rough estimate of your potential tax savings by looking at your income tax rate from the previous year and multiplying it by the amount you plan to contribute to a 529. For example, if you were taxed at 8% last year and plan to contribute $1,000 per year, the deduction could save you $80 per year.

What Are the Federal Tax Benefits of 529 Accounts?

Federal taxes represent the greatest tax burden for most taxpayers. And for residents of the nine states that don’t have an income tax, federal taxes might be their only tax burden.

When it comes to 529 plans, federal tax benefits are mostly reserved for the beneficiary of the account (the student) rather than the contributor (the parent or loved one). More on this below.

Tax benefits for beneficiaries

When funds are contributed to a 529 plan, they can be invested in assets like stocks or bonds. This money can then grow over time.

529s are tax-deferred accounts. This means that any profits or interest earned inside a 529 account will not be taxed in the year it is earned. This can create a significant advantage by allowing investments to grow without the year-to-year impact of taxes. The image below demonstrates the difference that tax-deferred accounts can make.

So, even if the account grows substantially, no tax will be owed until funds are withdrawn.

When funds are withdrawn, profits are tax-free so long as the money is used for qualifying education expenses, such as:

- Tuition and fees

- Books and supplies

- Room and board (college)

- Student loans (up to $10,000)

If the student withdraws money from their 529 and uses it for qualifying expenses, they won’t owe any money on the profits from the account.

To illustrate this, let’s look at an example.

A parent sets up a 529 plan for their newborn child. They deposit $10,000 and invest in diversified stock market index funds. The investments earn, on average, 7% per year.

After 18 years, the investments have grown to around $33,800, resulting in a profit of $23,800 (the end result minus the initial investment).

If the beneficiary withdraws the funds and uses them for a new car, they will owe tax on the $23,800 in profits. (If they’re in the 12% tax bracket, that could cost them $2,856 in federal taxes alone!)

But if the beneficiary uses the funds for college or another qualifying education expense, they won’t owe anything in taxes.

This is the primary benefit of 529 plans: Investments can grow tax-deferred, and withdrawals are tax-free as long as they are used for qualifying education expenses.

Tax benefits for contributors

For a parent or loved one who contributes money to a 529, there are no federal tax benefits. The contribution is not tax-deductible and does not qualify for any sort of federal tax benefit.

Gift tax rules

One final consideration with federal taxes is the gift tax. Contributions to someone’s 529 account are considered cash gifts for tax purposes.

When you give money or valuable items to someone, that gift may be subject to a gift tax. This tax is paid by the gift giver rather than the recipient.

Fortunately, it’s easy to avoid gift tax. Gifts of up to $17,000 are not subject to gift taxes. And this is a per-year limit — which means you can contribute up to $17,000 per year to your child’s 529 without worrying about gift taxes. You won’t even need to file a gift tax return.

This limit is also per-person. If you’re married, your combined limit is $34,000. And again, it’s per year — so you can contribute $34,000 this year and another $34,000 next year (if you're married).

Even if your gift exceeds this amount, you’re unlikely to owe gift tax due to a generous lifetime gift tax exemption. If you contribute more than $17,000 per year ($34,000 if you’re married), you will be required to file a gift tax return, but you won’t owe any taxes unless you’ve used up your lifetime exemption.

How Do I Claim 529 Contributions on My Taxes?

For federal tax purposes, there is no deduction for 529 contributions. You will not need to report anything on your federal tax returns.

The only exception is if you contribute more than $17,000 to the account in a calendar year. In that case, you’ll need to file a gift tax return and attach it to your income tax return.

For state taxes, the rules vary by state. Some states allow you to deduct the full 529 contribution amount, while others limit you to $1,000 or $5,000. You will need to check state-level rules with your state’s department of revenue or taxation.

Wrapping Up

There is no federal tax deduction for 529 contributions. However, most states offer a deduction when it comes to state-level taxes.

This deduction can help the contributor save some money. But remember, it’s the beneficiary who will receive the most benefit through the gift of tax-free growth over time.

Finally, remember that 529 tax benefits only kick in if the funds are used for qualifying education expenses. If you’re not sure whether the beneficiary will go to college, a good alternative is to open a custodial investment account. Custodial accounts have no restrictions on the use of funds — so your child can use them for a down payment, a wedding, or any other life goal.

EarlyBird is the best option for starting a custodial account for any child. The platform makes it easy for loved ones to get an account started, fund it, and invest in diversified portfolios.

{{cta-1}}

This page contains general information and does not contain financial advice. All investments involve risk. Any hypothetical performance shown is for illustrative purposes only. Actual investment performance may be different for many reasons, including, but not limited to, market fluctuations, time horizon, taxes, and fees. Please consult a qualified financial advisor and/or tax professional for investment guidance.

.png)