When we think of loans, we often think of mortgages and car loans — which often include reams of paperwork and strict requirements. But what about more informal loans from family or friends?

If you’re seeking a loan from a family member — or considering loaning money to a loved one — there are some important tax considerations to keep in mind.

This guide will focus on the tax implications of loans to family members. It’ll cover everything you need to know about lending money to loved ones, including how to structure the loan to minimize tax liability and how to make these informal loans IRS-compliant.

Basics of Family Loans

Family loans are person-to-person loans between family members or close friends.

They are generally informal, meaning that there’s no loan application process, credit reporting, or any of that.

There may be a basic contract or written agreement, or the loan may simply be a “handshake deal” (although it’s strongly recommended to put the loan details in writing — more on this below).

Family loans can be large or small and can be used for just about any purpose. For instance, an uncle might loan his niece $50,000 to help with a down-payment on her first home, or a mother may lend her son $3,000 to help with general expenses after a job loss.

There are significant benefits to family loans, such as:

- There’s no formal application process or credit pulls.

- Interest rates will typically be lower.

- These loans can help family members avoid high-interest predatory loans, such as payday loans.

At the same time, family loans can also have some downsides, such as:

- There’s a potential for conflict and awkwardness if the borrower is unable to repay the loan.

- These loans won’t help the borrower build personal credit, as no information is reported to credit bureaus.

- There may be tax implications for both parties (discussed more below).

It’s very important to consider the downsides of family loans — and particularly, the potential for awkwardness or family drama if something goes wrong.

Before you enter into a loan agreement with a family member, be sure to discuss your concerns with them.

Then there are the potential tax liabilities, which vary depending on the size of the loan.

Smaller family loans of less than $10,000 can typically be handled informally and aren’t subject to the same complex interest rate rules that larger loans are (more on this below).

Large family loans of over $10,000 can be a bit trickier and are subject to IRS tax rules.

Do Family Loans Get Taxed?

Loans between family members may create tax liabilities for either the lender or the borrower — or both. It all depends on how the loan is structured and how large it is.

First off, family loans should always be made official through the use of a basic contract that both parties sign. This is an IRS requirement — without a contract, the IRS may consider the transaction a gift instead of a loan, and it may be subject to gift tax rules.

The IRS also prefers that lenders charge interest on loans made to family members. While interest-free loans are possible, the tax reporting rules are much more complex.

It is the interest payments that may be subject to income tax, not the loan itself. So if you loan someone $50,000, neither of you will pay tax on the loan amount — but you’ll likely need to pay income tax on the interest payments you receive from the borrower.

And if you don’t charge interest, you may be required to pay tax on the interest you could have charged, and things get a little messy. Usually, it’s far simpler to just charge the borrower a modest amount of interest.

Fortunately, smaller loans under $10,000 aren’t generally subject to the minimum interest rules. So a smaller loan can be made interest-free without too much of a tax headache.

Tax implications for the borrower

On the borrower’s side, there are typically no tax implications. The borrower doesn’t typically need to report the loan and won’t pay any income tax on it.

In some cases, the borrower may get a tax perk from borrowing money from family. This is only the case if the borrowed money is used to purchase a home.

If the money is used for a home purchase, the loan agreement could be set up to be structured like a second mortgage. This may require the help of a CPA to draft an appropriate loan agreement.

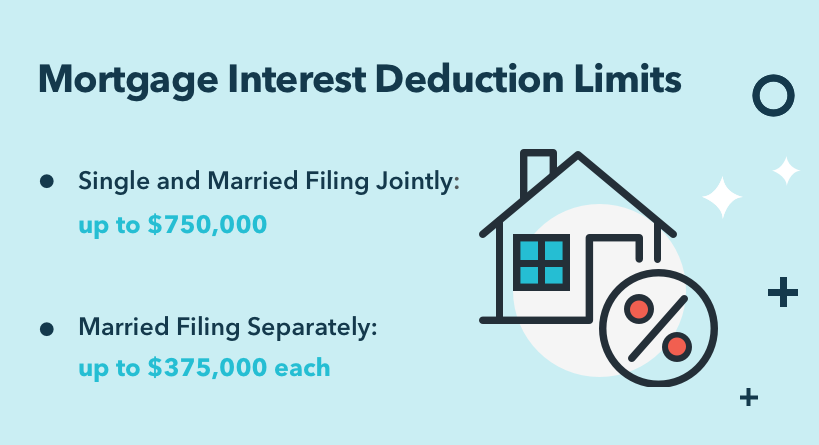

If the loan is structured as a second mortgage, the borrower may be able to deduct the interest portion of payments under the Home Mortgage Interest Deduction rules.

This can be tricky, though — it’s best to speak with a tax advisor for help.

Also, the mortgage interest deduction is only relevant if the borrower itemizes deductions. Only around 13.7% of American taxpayers itemize their deductions, so the home mortgage interest deduction won’t be relevant for most borrowers.

Tax implications for the lender

The main tax implication of a loan to a family member is that the lender must pay tax on the interest they earn from the loan.

For instance, if you lend $100,000 at an interest rate of 4%, you would earn approximately $4,000 each year in interest income. This $4,000 will be treated as taxable income, and you must report it when you file your taxes.

And here’s where it gets weird: If you charge no interest or an interest rate below the applicable federal rates (AFR), you may owe tax on the interest you should have earned.

These so-called “imaginary interest payments” can create some tax headaches if you’re not prepared.

The difference between the interest rate charged and the applicable federal rate is known as the imputed interest. And it’s this figure that you’ll use to calculate what you may owe in taxes.

Unfortunately, there’s a double tax hit with imputed interest. You’ll have to pay income tax on the interest you should have earned, and you may need to report the interest the borrower should have paid as a “gift” to the borrower.

This all gets a bit complicated. If you don’t want to charge interest on the loan, it’s best to keep the loan under $10,000 to avoid complex rules.

For interest-free (or very low interest) loans over $10,000, it’s best to talk with a tax professional for advice.

Keeping things simple

Ultimately, the simplest way to loan money is to charge at least the minimum interest rate, which is published each month by the IRS.

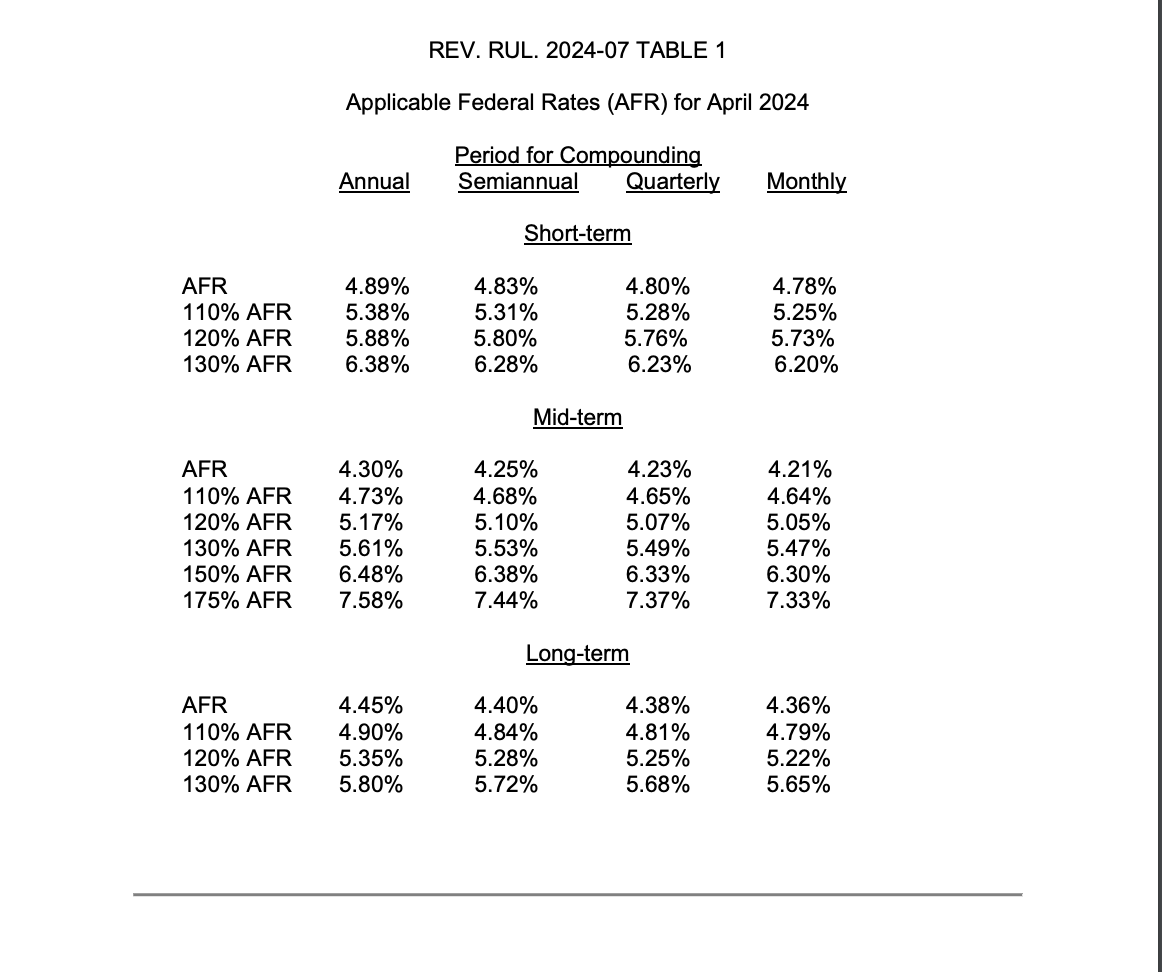

These rates are quite low, ranging from 4.83%–7.44% as of April 2024 (depending on the loan length).

As long as you charge interest that matches or exceeds the AFR, you simply need to report the interest you actually earned as taxable income — which is much simpler than figuring out imputed interest income.

How to Make an IRS-Compliant Loan to a Family Member

If you decide to loan money to family, here are some general guidelines to follow in order to stay compliant with IRS rules.

1. Make a written loan agreement. If there’s no written agreement, the IRS may consider any money transferred between family members to be a gift — potentially making the transaction subject to gift tax. Use a loan agreement template to make things easy.

2. Agree to a repayment schedule. Set a well-defined repayment schedule in your loan agreement to avoid complications.

The rules discussed in this article are primarily for term loans — for instance, a five-year loan with monthly payments or a six-month loan with biweekly payments. The rules for demand loans (which have no formal repayment schedule) are different and can be more complex.

3. Charge interest based on the applicable federal rates. If you structure the loan to charge a small amount of interest based on the applicable federal rates, you’ll avoid most of the complexities of the tax code. And the borrower will still enjoy a much lower interest rate than would be available from a traditional lender.

The interest rate is set for the life of the loan, as long as there’s a clearly defined loan term. Here are the rates as of April 2024 (these change every month — check here for the latest rates).

4. Report income earnings as taxable income. Any interest that the borrower pays you should be reported as taxable income when you file your taxes. The borrower doesn’t need to report anything.

5. Consult a tax advisor if you want to make a zero-interest loan. If you don’t charge the applicable AFR or higher, or you make a zero-interest loan, the rules are more complex. It’s best to consult a tax advisor in this case.

Alternatives to Loaning Money to Family

In some cases, it may make more sense to avoid making a loan to a family member. This could be for tax reasons or personal reasons — like not wanting to create awkwardness in your family dynamic.

Two of the best alternatives are to simply gift money rather than loan it and to offer to cosign on a traditional loan.

Gifting money

Having family members who owe you money can certainly create some awkwardness around the holiday table. Plus, as described above, loans to family members have some potential tax implications.

A cleaner alternative, if you are willing, is to simply give the money to the relative as a gift.

For instance, if your granddaughter wants to buy a home but doesn’t have much saved for a down payment, you could gift her $40,000 to help out. This would avoid the tax implications of a loan, as well as the potential awkwardness.

Plus, a loan could affect her ability to obtain a mortgage — because her debt payments to you would be taken into account by the lender when calculating her debt to income ratio.

A gift, on the other hand, wouldn’t affect mortgage eligibility at all.

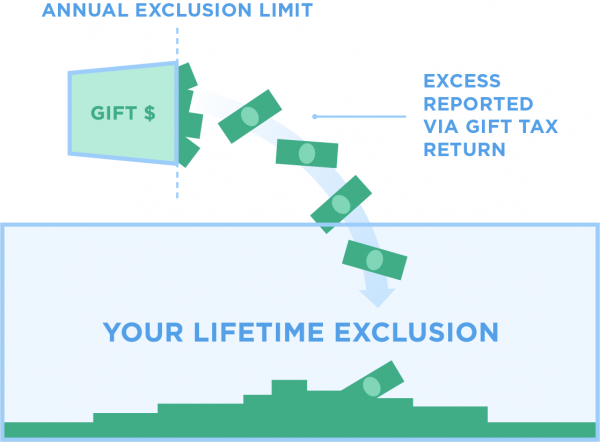

Keep in mind that gifts may still be subject to tax reporting requirements. However, most gifts won’t actually result in a tax bill due to generous exemptions.

In 2023, you can gift up to $17,000 tax-free without filing a gift tax return. This annual exemption is per person, so married couples can gift up to $34,000 tax-free.

It’s also per recipient, so you and your spouse could gift each of your three children up to $34,000 each, per year, without filing any sort of gift tax return.

If you make a gift over the limit, you’ll need to file a gift tax return. However, you likely still won’t owe any actual tax due to the generous lifetime gift tax exemption.

Basically, each person is allowed to gift up to $12.92 million throughout their lifetime without paying a dime in gift taxes. This is in addition to the annual exemptions.

For example, a gift of $100,000 from a single father to this daughter would use the full annual exemption of $17,000 and then reduce the father’s lifetime exemption by the remaining $83,000. No gift tax would be due.

Full gift tax details can be found on the IRS’ instructions for form 709 - Gift Tax Return.

Cosigning a loan

Another option is to cosign on a standard loan with the borrower.

For instance, if your nephew is seeking a $50,000 personal loan but doesn’t have the best credit, you could offer to cosign on a standard bank loan.

Assuming that you have better credit, this could help him secure the loan and likely pay a lower interest rate than he otherwise would have.

What this means is that you’ll share responsibility for repaying the loan. Should your nephew fail to repay the debt, you’ll be on the hook.

There are still obvious downsides to this approach, but the benefit is that you avoid any tax trickiness. Plus, the borrower has the benefit of building a positive credit history by making regular payments towards a formal loan.

Cosigning a loan won’t have any tax implications for you or the borrower, and the borrower can simply shop around for the best rate from traditional lenders.

Conclusion

It’s important to understand the specific rules for intra-family loans laid out by the IRS.

For the simplest route, it’s best to set clear terms in a written agreement and charge a small amount of interest in line with the applicable federal rates.

In this case, the lender will need to report and pay income tax on the interest but will avoid any of the more complex tax situations that come along with interest-free loans.

Want to learn more about personal finance and giving money to loved ones? Check out the EarlyBird blog for a variety of helpful resources and insights.

{{cta-1}}

This page contains general information and does not contain financial advice. All investments involve risk. Any hypothetical performance shown is for illustrative purposes only. Actual investment performance may be different for many reasons, including, but not limited to, market fluctuations, time horizon, taxes, and fees. Please consult a qualified financial advisor and/or tax professional for investment guidance.